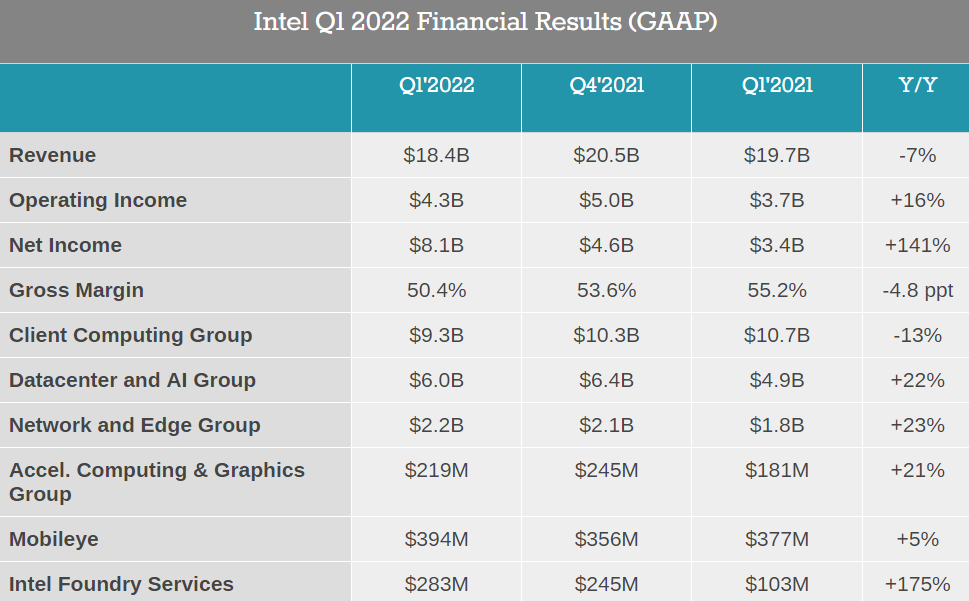

Intel announced its financial report for the first quarter of 2022 this morning, with a slight decrease in revenue, but a significant increase in net profit, and most business divisions are also optimistic.

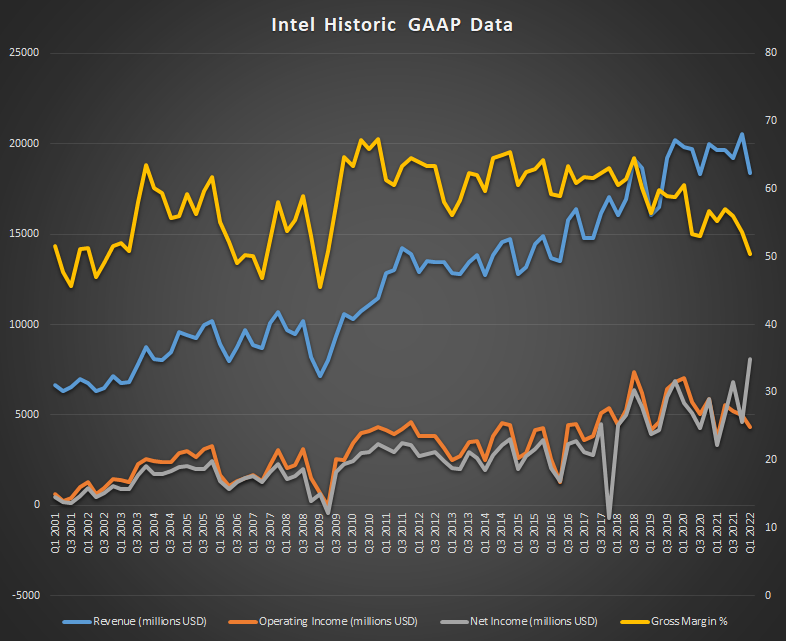

In the quarter, Intel achieved total revenue of US$18.4 billion, down 7% year-on-year; operating profit was US$4.3 billion, up 16% year-on-year; net profit was US$8.1 billion, up 141% year-on-year; gross profit margin was 50.4%, down 4.8 percentage points year-on-year.

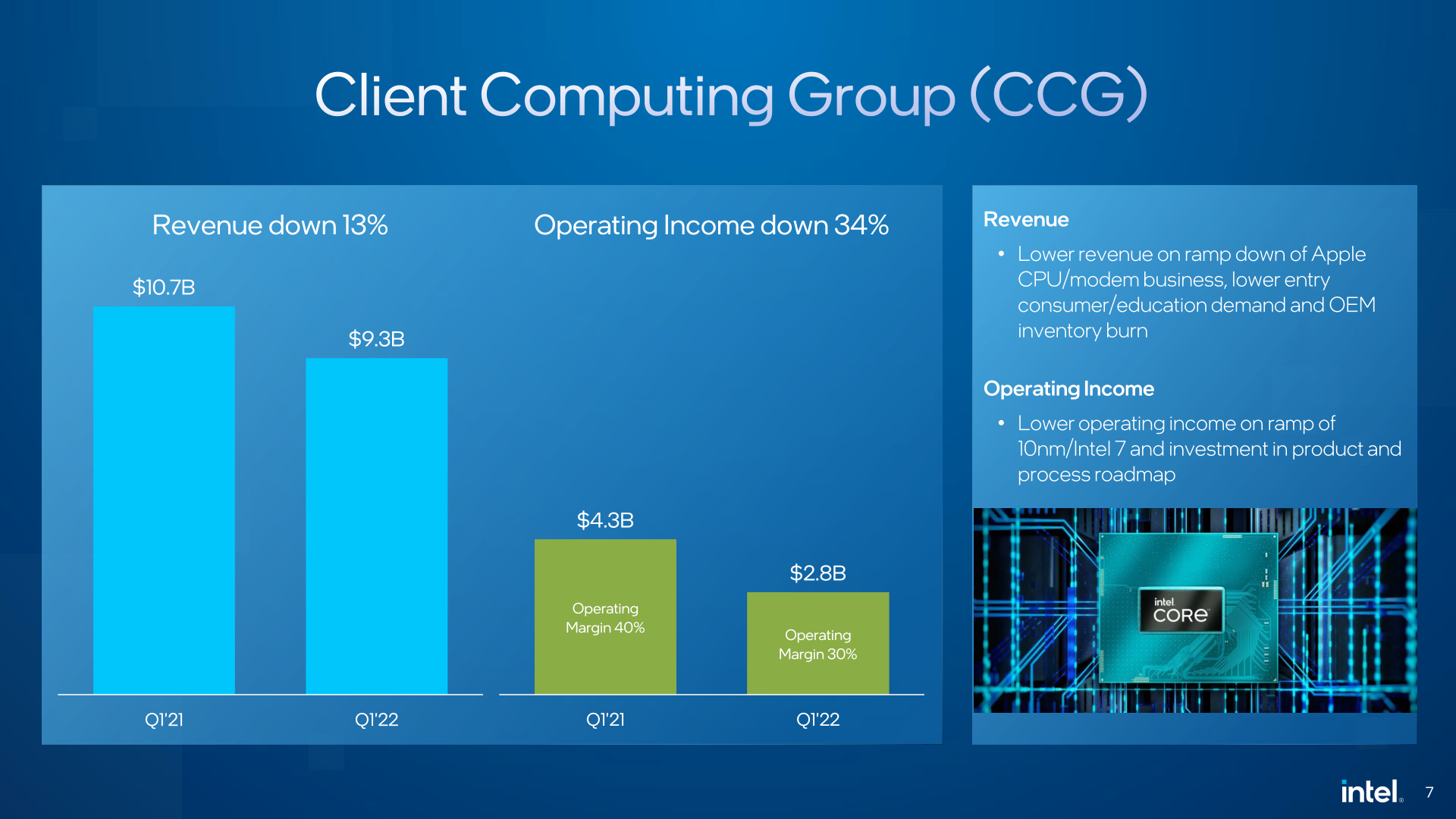

Among them, the core processor-based Client Computing Division (CCG) revenue was 9.3 billion yuan, down 13% year-on-year, mainly due to the decrease in Apple processor/baseband revenue, the weakening of entry-level consumer and education market demand, and the impact of OEM inventory .

The Xeon processor-based Data Center and AI Division (DCAI) recorded revenue of US$9 billion, a year-on-year increase of 22%, mainly due to stronger demand for Xeon from large data centers and enterprise customers;

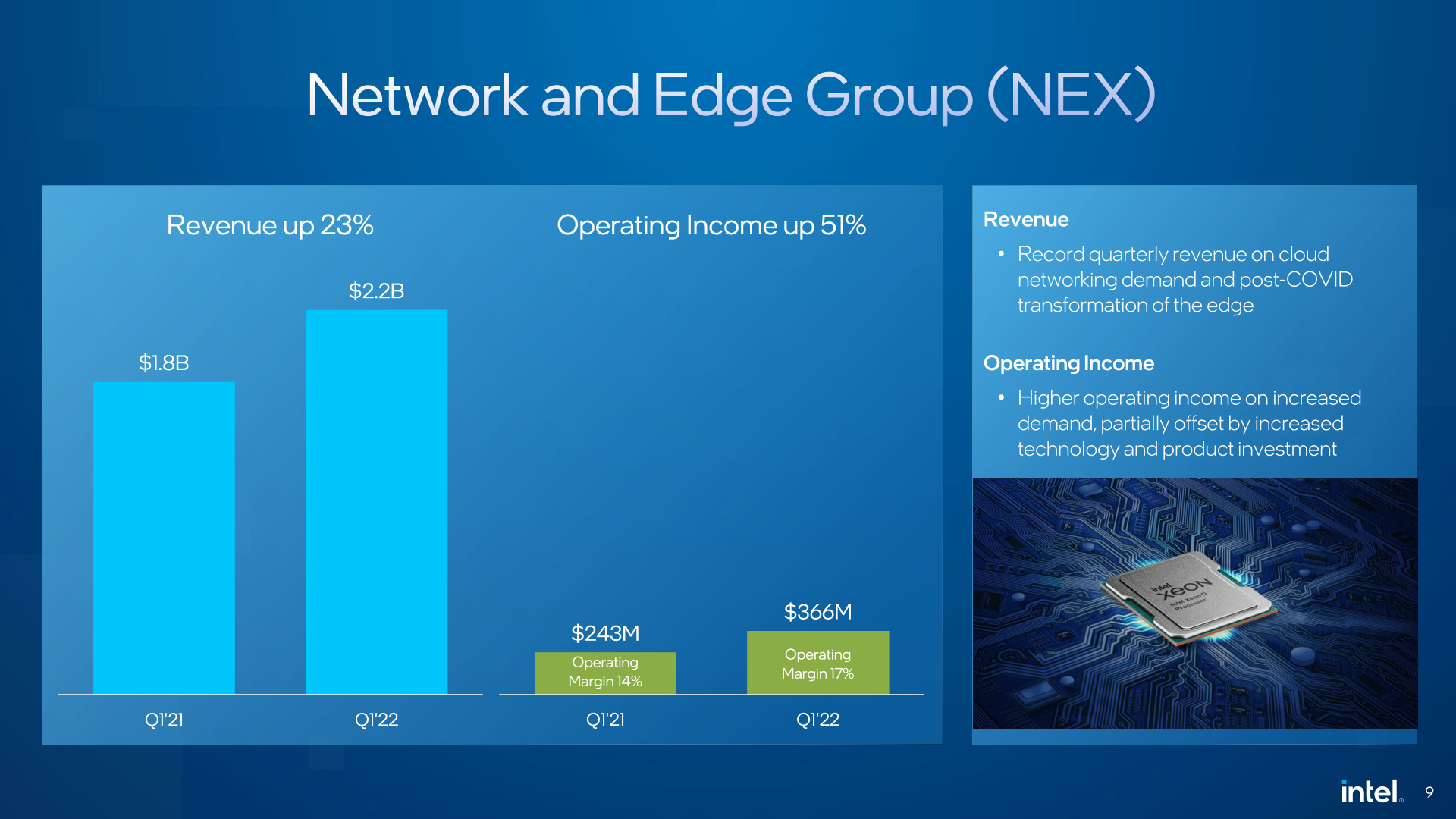

The network and edge business unit's revenue was US$2.2 billion, a year-on-year increase of 23%, mainly due to the record high demand for cloud networks and the promotion of edge computing upgrades due to the new crown epidemic;

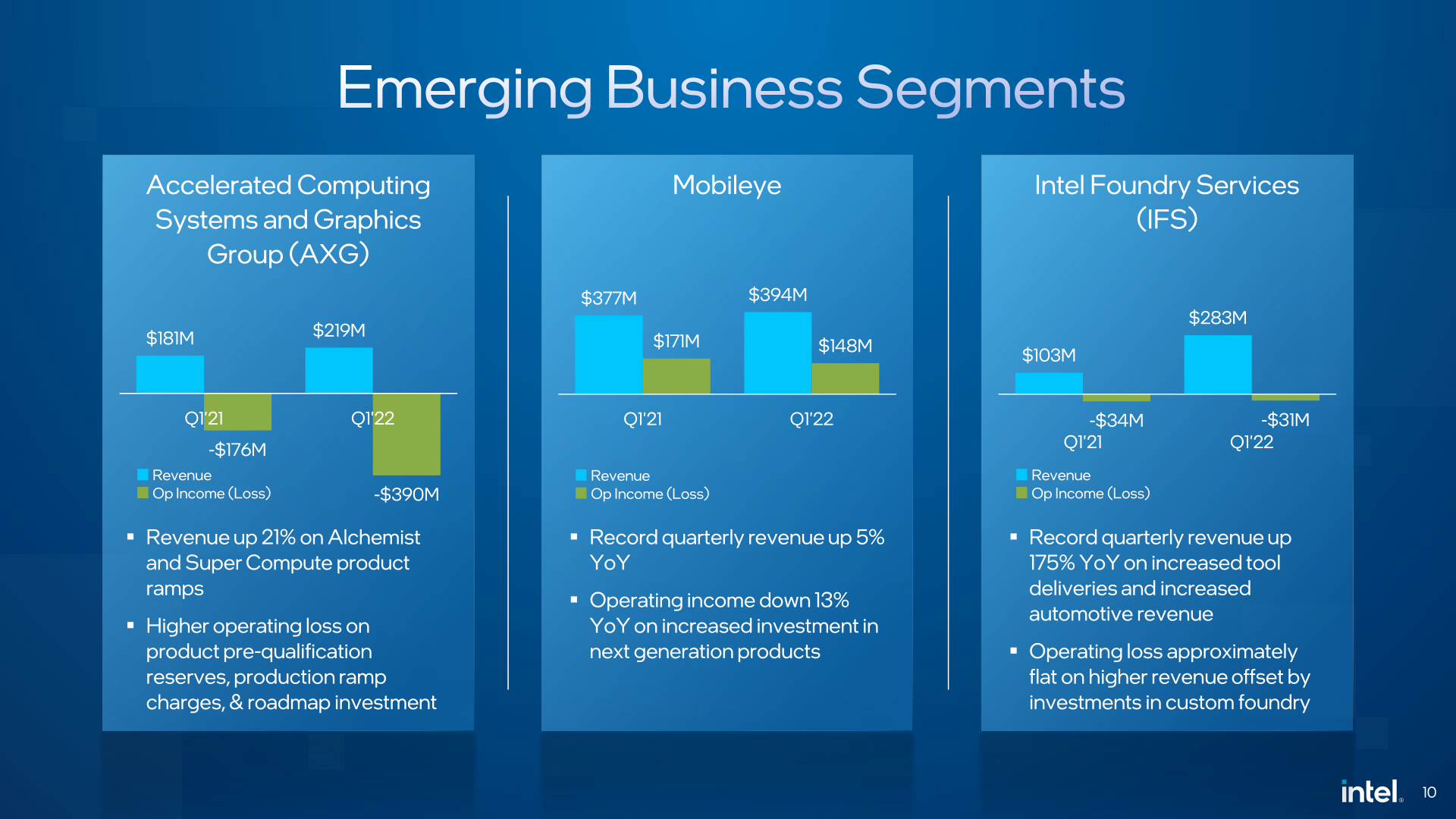

The Accelerated Computing and Graphics Division (AXG), which is dominated by discrete graphics cards, recorded revenue of US$219 million, a year-on-year increase of 21%, mainly due to the promotion of Alchemist DG2 gaming graphics card and Ponte Vecchio accelerated computing card products;

Mobieye’s self-driving business unit’s revenue was US$394 million, a year-on-year increase of 5% and a new high;

Foundry Services (IFS) revenue was $283 million, a year-on-year increase of 175% and a record high.

Looking forward to the second quarter of 2022, Intel expects revenue of $18 billion, down 3% year-on-year; gross profit margin is 51%, down 8.8 percentage points year-on-year.

For the entire fiscal year 2022, Intel expects revenue of US$76 billion, a year-on-year increase of 2 percentage points; gross profit margin is 52%, a year-on-year decrease of 6.1 percentage points.